If you are looking for a way to pass on some of your assets to your family while reducing or eliminating gift or estate taxes, a charitable lead trust is an excellent option.

It is possible to set up a lead trust that will allow you to transfer assets to your family with zero transfer taxes. The IRS assumes that a lead trust is only earning at the current low federal rate. If the actual investments of the trust produce a higher return than the payments made to Purdue over the term of the trust, the full value of the trust may be transferred to family with zero gift tax.

To discount your gift to family even more, you may consider first transferring your real estate or other assets into a family limited partnership (FLP), which will fund your lead trust. The combination of the FLP, the lead trust, and a gift exemption can permit the lead trust to pay income to Purdue for a number of years and potentially transfer substantial assets tax-free to your family.

With increased volatility in the stock market, you may want to create a lead trust that makes fixed payments of increasing amounts to Purdue over time. Because the payments to us are fixed, your family ultimately benefits from any growth in the trust. Low payouts in early years allow the trust to grow, thus providing protection should the economy produce below-average returns in the future.

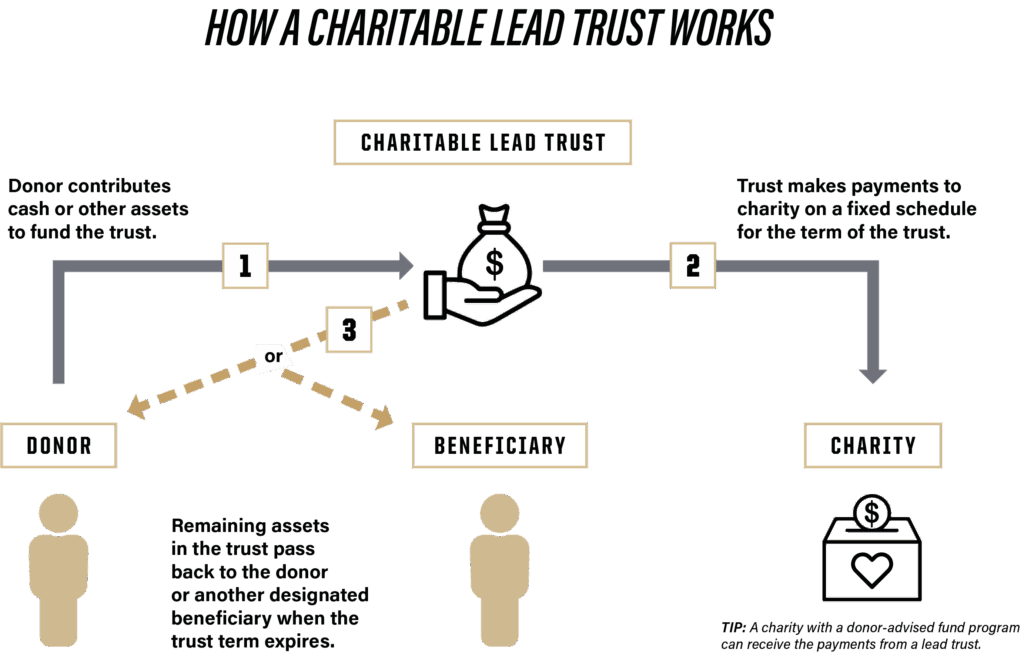

You may also consider a grantor lead trust, which permits you to transfer your cash or assets to a trust that will make gifts to Purdue for a number of years. At the end of the trust term, you receive the assets back from the trust.

You make a contribution of your property to fund a trust that pays Purdue income for a number of years. You receive a gift- or estate-tax deduction at the time of your gift. After a period of time, your family receives the trust assets plus any additional growth in value.

Questions?

Phone: 765-494-8657

Email: plangift@purdueforlife.org

Mailing address: 403 West Wood Street, West Lafayette, IN 47907

Meet Our Team