Each child must always be accompanied by an adult. One adult can bring two children, provided that all three attend the same class and stay together as a group. In some sessions, this will mean sharing equipment and working together as one unit. Participants registered in the same group will be placed in the same major and field trip.

While this program is designed for grandparents and grandchildren, we recognize that situations may arise where a grandparent is unable to attend. In these cases, a child’s relative—excluding a parent—may accompany them to the program. The child’s parent or legal guardian is required to sign permission forms prior to the event.

Children must be 7–14 years old by the date of the event.

All children must be accompanied by an adult at all times, so each child would need at least one adult with them. To be placed in separate majors, you must register in separate groups.

No! Grandparents University is open to all family, friends, and fans of the university.

Yes, parents or guardians of participating children may attend the graduation ceremony in the Elliott Hall of Music. The ceremony will not begin until 1:15 p.m. on Friday. We recommend not showing up too early because the doors will be locked until the students are ready to enter. Please wait at the Elliott Hall of Music—do not show up to the Purdue Memorial Union.

The locations of several of our majors are within walking distance from the Purdue Memorial Union, which is where our main activities will take place. Buses will be available on a limited route for majors that require transportation. While these buses may not be able to offer door-to-door service, they reduce the amount of walking. A campus map will be provided upon arrival.

Commuting participants are encouraged to park in the Grant Street Garage at the posted hourly rate or use parking meters that use the ParkMobile app; payment of fees is required as posted. Visitors may also purchase a visitor permit online. Visitors with permits must still observe special postings including reserved spaces or spaces for accessible parking.

Campus visitors can purchase a daily permit, which costs $5 per day. With a daily permit, unless restrictions are posted that indicate otherwise, visitors may park in any “A,” “B,” or “C” space—excluding the Grant Street and Harrison Street parking garages. Daily permit parking is valid Monday through Friday for the entire day of its purchase. Please visit Purdue’s visitor parking page to purchase a daily permit and for more details.

Yes. A shuttle from Frieda Parker Hall will be available Thursday morning to Memorial Mall and Friday morning to the Purdue Memorial Union. There will also be a shuttle loop from the Boilermaker Block Party to Frieda Parker Hall on Thursday evening.

Purdue University encourages programs and activities that enhance learning and stimulate creativity in youth. The success of these programs depends on careful planning that makes safety the highest priority. The Programs Involving Minors Policy (III.A.6) and its associated Operating Procedures for Programs Involving Minors reinforce the safety of minors by putting in place requirements for background checks, program registration, training, and other safeguards based on the type of program.

A $5 daily permit will allow visitors to utilize spaces that require an “A” permit and a disability license plate or official placard. Please visit Purdue’s parking website to purchase a daily permit and learn more about accessible parking options around campus.

We want to make sure our program is accessible to everyone. For that reason, there is space on the GPU registration form to list any accommodations you may need. We also have included the activity levels for both majors and field trips on our website. Please read those carefully before completing your registration.

While registering early gives you the best chance of securing a spot at Grandparents University, it does not guarantee placement in preferred majors. Some of the majors are limited in size due to availability of equipment or the venue. We do strive to ensure that each participant gets placed in a major ranked in their top seven, so please keep that in mind when ranking your preferences.

Reminder: Participants registered in the same group will be placed in the same major and field trip. To be placed in separate majors, you must register in separate groups.

During the registration process, you will rank your major preferences from one to seven, with one being your favorite. We cannot guarantee placement in any major. However, we do strive to ensure that each participant gets placed in a major ranked in their top seven, so please keep that in mind when ranking your preferences. Major assignments will be sent to the primary registrant’s email in early June. Personalized schedules with details will be sent out one week before the event.

On March 1, a full list of our 2025 majors and field trips—as well as their descriptions and activity levels—will be available on our website.

You will receive an email in early June, that includes both your major and field trip information.

Our team goes through a thorough and thoughtful process to ensure everyone is placed in one of their top seven majors. Many factors are taken into consideration when assigning majors, including classroom ratios, availability of equipment and facilities, and keeping families together. We understand it can be disappointing to not receive one of your top choices, but hopefully you can use this opportunity to build excitement about learning something new together.

The Grandparents University program makes every effort to contact and encourage participation from each college at Purdue. Due to prior commitments and space constraints, not all colleges can participate each year.

Do you have a request for a college or course? Let us know at specialevents@purdueforlife.org.

We will be offering two sessions for Grandparents University 2025: July 17–18 and July 24–25.

Specific details will be sent to participants two weeks before the event.

Yes. We have secured a room block at the Union Club Hotel on campus. Please check out the Lodging page for room rates and hotel information.

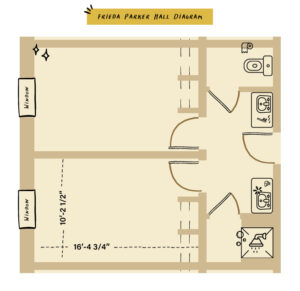

Frieda Parker Hall was selected based on several important requirements, including availability, accessibility, and private bathrooms. It offers semi-suite style rooms that accommodate four people per suite.

One semi-suite includes two rooms and four single beds. If your party exceeds four people, you must purchase an additional semi-suite.

No. If you have medicine or other health-related items that need to be refrigerated, please indicate this in the “Special Accommodations” section of your registration or notify us prior to arriving on campus. Arrangements can be made if we receive advance notice.

Your GPU registration fee includes one breakfast on Friday morning, two lunches, and one dinner. On Thursday morning, light refreshments and breakfast snacks will be available throughout registration. Snacks will also be provided during breaks.

All allergies are taken very seriously and communicated with our culinary teams. If you or your grandchild have a food allergy, please make sure to indicate that during the registration process under “Special Accommodations.”

You must cancel your registration by Friday, June 13, 2025, to receive a refund. (The $50 administrative fee is nonrefundable.) Many of the costs associated with GPU are incurred prior to the program. Please consider the cancellation date carefully when registering. In the event of a family emergency, special arrangements will be considered.

Substitutions are allowed if the substitute completes the necessary waivers and returns them to us—signed—at least 30 days prior to the program start date. Substitutes must be in the same age group of the person they are replacing.

The registration fee includes four meals, five and a half hours of class time, admission to evening activities, an event T-shirt, transportation around campus, and other program items. You may wish to bring money for vending machines and souvenirs.

Purdue University prohibits the possession, use, or distribution of any explosives, guns, or other deadly or dangerous materials or weapons reasonably calculated to cause bodily injury in university facilities.

No illegal drugs or alcoholic beverages are allowed during the GPU program. GPU staff members reserve the right to remove participants who are under the influence or prohibit them from participating in the GPU program.

Office of Special Events

765-494-0900

specialevents@purdueforlife.org